IFRS 9 – SOFTWARE AND EXCEL BASED MODELS

BACKGROUND

- Post 2008 financial crisis, regulators around the world realized that history based accounting standards can be extremely misleading and a paradigm shift in accounting methodologies is needed.

- In July 2014, IASB issued IFRS 9 standard which replaced existing IAS 39 provisioning method. The IASB stated that the IAS 39 incurred cost method leads to delayed recognition of credit losses, thus a forward looking approach is being introduced.

- IFRS 9 became effective worldwide on Jan 2018 and has since then posed huge challenges for accounting firms, auditors and corporations who were neither used to deal with such predictive analytics nor qualified to do so.

PROVISIONING UNDER IFRS 9

- Incurred Loss Provisioning Method under IAS 39 has been replaced by Expected Loss Provisioning Approach of IFRS 9 where provisions are taken upfront and Expected Credit Loss (ECL) is estimated as a product of EAD, PD and LGD.

- Definition of EAD is different for each of 3 buckets, term structure of applicable point in time PD is also different for each of 3 buckets of EAD, and LGD is estimated differently for collateralized and non-collateralized exposures.

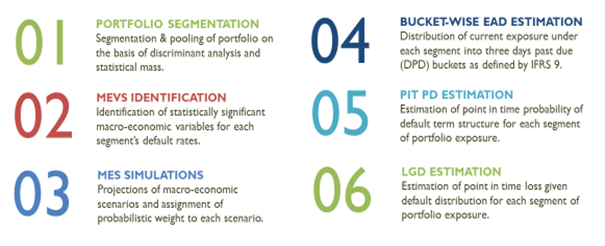

OUR ECL Estimation Methodology

HOW IS IT DIFFERENT FROM BASEL?

HOW IS IT DIFFERENT FROM RATING MODELS?