IFRS 9 – SOFTWARE AND EXCEL BASED MODELS

BACKGROUND

- Post 2008 financial crisis, regulators around the world realized that history based accounting standards can be extremely misleading and a paradigm shift in accounting methodologies is needed.

- In July 2014, IASB issued IFRS 9 standard which replaced existing IAS 39 provisioning method. The IASB stated that the IAS 39 incurred cost method leads to delayed recognition of credit losses, thus a forward looking approach is being introduced.

- IFRS 9 became effective worldwide on Jan 2018 and has since then posed huge challenges for accounting firms, auditors and corporations who were neither used to deal with such predictive analytics nor qualified to do so.

PROVISIONING UNDER IFRS 9

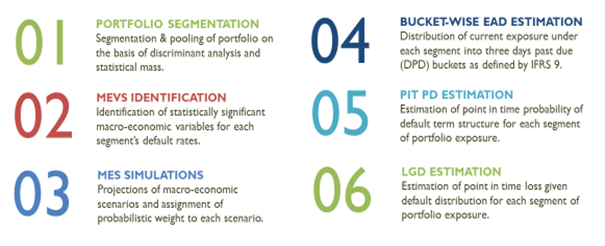

- Incurred Loss Provisioning Method under IAS 39 has been replaced by Expected Loss Provisioning Approach of IFRS 9 where provisions are taken upfront and Expected Credit Loss (ECL) is estimated as a product of EAD, PD and LGD.

- Definition of EAD is different for each of 3 buckets, term structure of applicable point in time PD is also different for each of 3 buckets of EAD, and LGD is estimated differently for collateralized and non-collateralized exposures.

OUR ECL Estimation Methodology

HOW IS IT DIFFERENT FROM BASEL?

HOW IS IT DIFFERENT FROM RATING MODELS?

IFRS-E®

| Software Package Features |

|

-

Complete IFRS 9 estimations and disclosures in accordance with Simplified Modeling Method prescribed by Global Public Policy Committee (GPPC) of the representatives of the 6 largest accounting firm in their joint document issued in June 2016.

-

Comprehensive estimations of EAD, PIT PDs, and LGDs for counter party receivables including Banking and Sovereign receivables.

-

Strong technical support system with assistance from dedicated helpdesk.

-

Suitable for financial sector companies including banks, leasing companies, investment banks, mortgage finance houses, insurance companies, investment companies etc.

-

Customized to comply with reporting requirements under SBP circular 4 of 2019.

-

Consolidated solution including the software installation, country specific customization, full integration with bank’s internal database systems, and strong on-ground technical support with annual validation services.

IFRS9-Estimator – Product Features

-

Provides a comprehensive end to end solution for the estimation of ECL provisions under current IFRS 9 requirements.

-

Supports all major IT platforms and browsers.

-

Easy to use & requires minimum data input from its users.

-

Equally capable of estimating ECL for large input data stream; as well as for a minimum of single quarter’s input data.

-

Comes with free on-site users training and very strong technical support point forward.

-

Provides free software updates as and when IFRS amends or refines its methodology.

-

Available in 3 versions to cater to varying needs of corporate clients.

IFRS9-Estimator – Structural Architecture

- In compliance with modeling methodologies agreed in GPPC document jointly published by 6 largest accounting firms.

- Extensively tested by the Chartered Accountants worldwide.

- Validated by globally renowned quants and verified by clients’ external auditors.

- Excel versions of software already in use in over 56 companies across 17 countries.

IFRS9-Estimator – Integration Process

IFRS9-Estimator – 4 Tier 24/7 Support System